APPLY ONLINE OR BY PHONE

info@pro-financing.com | 954-862-2610 (9am CST - 5pm CST)

Best Startup Financing & Business Loans of 2021

Start Up Business Financing $10,000 to $150,000

Business Loans Ranging From $25,000 to $500,000

Do Funding Options for Startups and Businesses with LESS Than Two Years In Business Really Exist?!

YES!

- Free To Apply

- Apply In Under 2 Minutes

- No Financials or Tax Returns

- No Collateral Required

- Start Up Businesses Funded

- Flexible Payment Options

This is a Pre-Approval.

We Will NOT Be Doing Anything That Could Negatively Affect You or Your Business

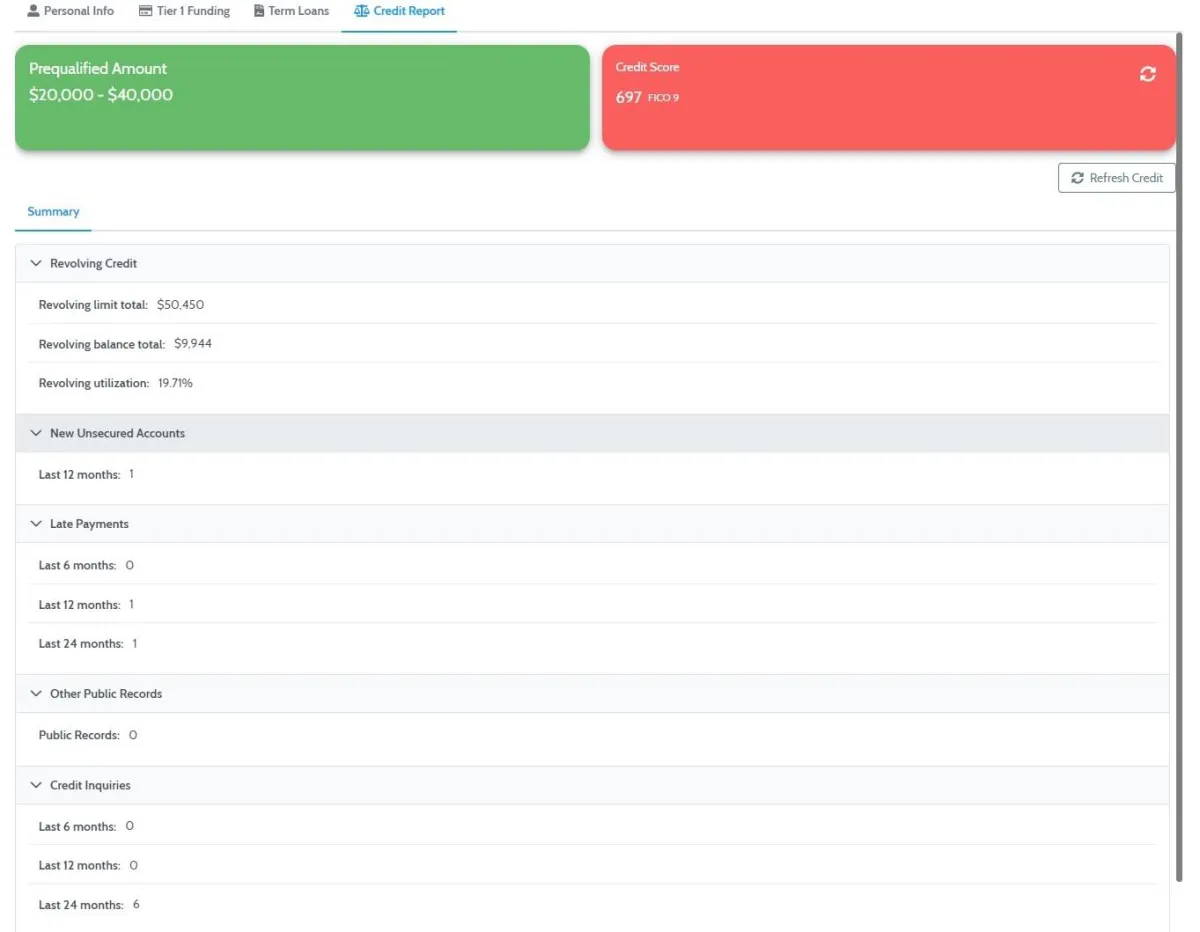

After 30-days of working with ProFinance, Cameran was able to NOT ONLY get the start up funding of $40,000 at 0% for 12 months to launch his eCommerce store, but we also SET UP HIS BUSINESS CREDIT, allowing him to start investing in Real Estate, WITHOUT taking a Hard Money Loan!

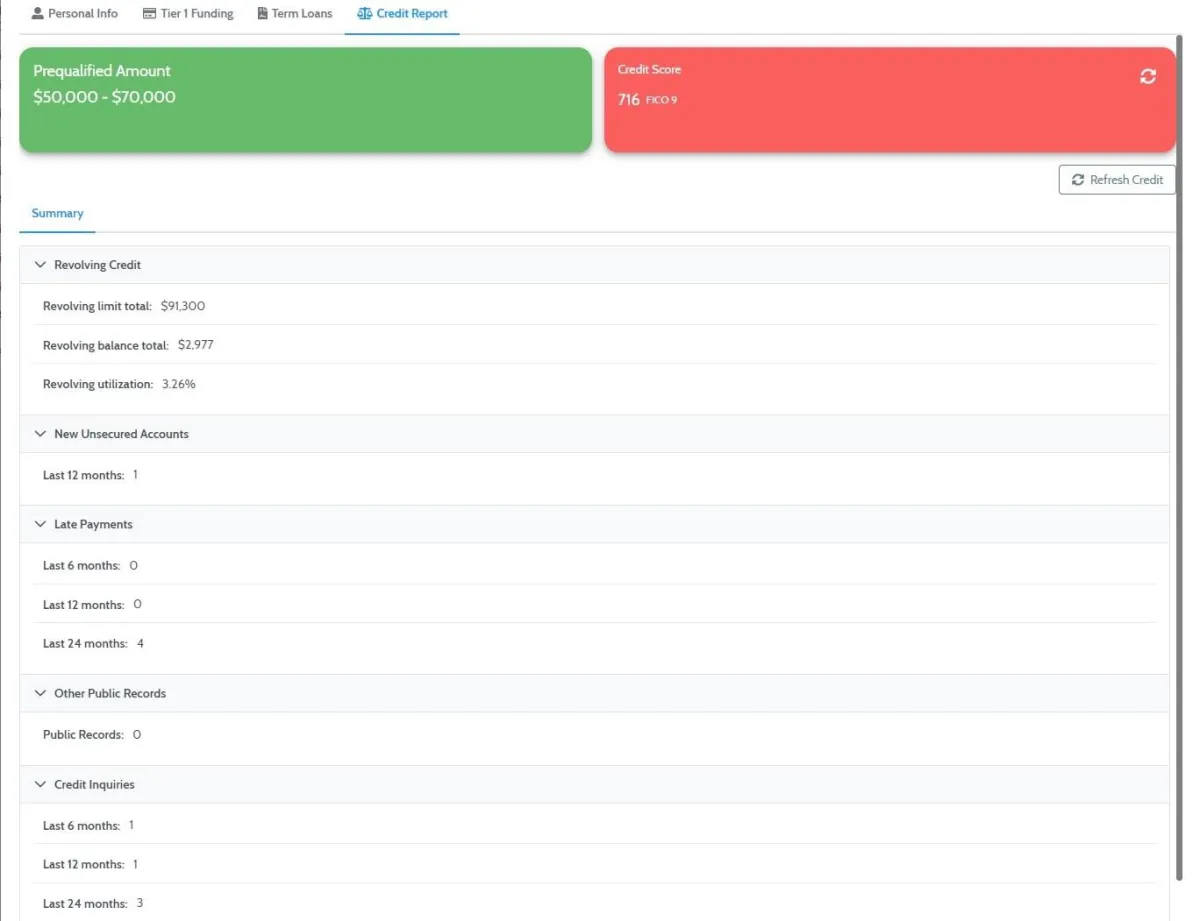

Rachel is a Female Entrepreneur and within 60-days we NOT only got her 0% financing for $70,000, BUT we also got her a SBA loan and a True Business Line of Credit for an additional $50,000. Total Funding within 60-days with ProFinance = $470,000!!!

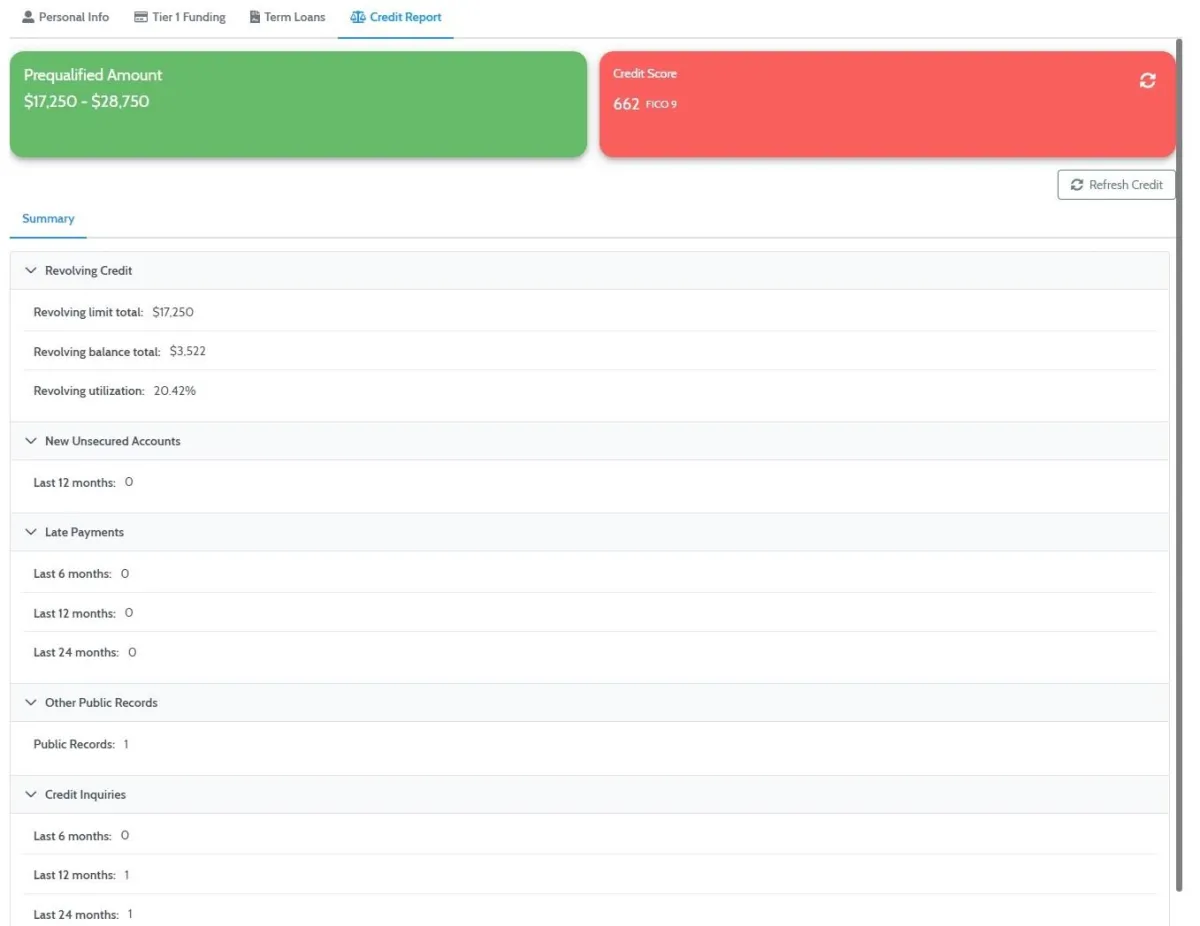

Morgan's personal credit score was holding him back from growing & expanding his business. Within 30 days ProFinance was able to boost his credit score 150 points and get him financing of $30,000 at 0% for 12 months!!

How Do I Qualify For A Start Up Business Loan?

The best way to qualify for a startup business loan is to have and maintain good credit. With a FICO score of 650+, you may be able to qualify for between $5,000 and $100,000 based on just your personal credit.

Let’s break down how to qualify for each type of startup business loan:

When you are trying to raise startup business funding through friends and family, it does not take much more than trust to qualify. Even though you are getting the money from friends or family, however, you will still want a well-thought-out business plan. You will also want a clearly defined agreement so the terms under which you are required to pay back the money are very clear.

Qualifying for an SBA startup loan is much more difficult. The documentation alone is significant. You will need a business plan, financial projections, a profit and loss statement, a balance sheet, personal financial statement, and business financial statements. The process usually takes more than six months. If you have 20 percent to 30 percent to contribute, however, you can likely get approved for an SBA startup loan.

Business credit cards can be a helpful part of any startup business funding plan because qualifying is relatively easy, and you can get 0 percent interest and rewards on many cards. In order to qualify for business credit cards, you will need business registration documents, an EIN and articles of incorporation. With these documents on hand, the only other thing that you need to qualify for business credit cards is a FICO score of 650+. With a FICO of 650+, you can potentially qualify for multiple 0 percent interest credit cards. Equipped with these cards, you can make purchases for your business and just pay back the principal amount without interest before the 0 percent rate period ends.

In order to qualify for crowdfunding, you will need a lot of documentation as well as marketing materials to get people to invest in your business. In particular, you will need a business plan, a compelling pitch and business registration documents. You do not need any time in business to do a crowdfunding campaign. You just need to put together a strong marketing plan to get people to invest in your idea or company. Social media marketing should be a substantial part of any successful crowdfunding campaign.

To qualify for a 401k startup business loan, you must first have money in a 401k or other qualifying savings account. If you do have a well-funded 401k, then you just need to follow all loan or withdrawal application processes carefully. You will need a business plan, financial projections, a profit and loss statement, a balance sheet, and personal financial statement. As long as you have the money in your 401k and follow all of the laws, you should be able to access that money to start your business.

Equipment financing has different requirements than other startup business loan options. In terms of documentation, you will need bank statements, financial projections, balance sheets and an approved purchase order. The key is the approved purchase order. This document allows the equipment financing company to understand exactly how the money is going to be spent and it can include the terms outlining what will happen in the event you default on the loan. In order to qualify for equipment financing, you also have to have been operating for more than six months.

In addition to types of financing and business loans, startups can attract angel investors. These investors require documentation such as a business plan, financial projections, a profit and loss statement, and personal financial statements. If you have all of this documentation, there is no minimum time in business requirement. With this type of funding, you do not repay a loan but instead give the investors equity in your company.

What Documents Do I Need To Apply For a Traditional Startup Loan?

For most small business startup loans, you will need the following documentation:

EIN number

Articles of incorporation

Personal financial statements

Business financial statements, if available

Profit and loss statements

Balance sheets

Cash flow statements

Tax returns

Personal credit information

Startup business financing companies and lenders require different documents depending on the type of loan you are applying for and the terms of the loan or funding type. For example, to get business credit cards, you only need your EIN and other personal information for the bank to assess your credit score and issue you a card. For equipment financing, on the other hand, you need to present a lot more documentation.

Loans through friends and family can have much more flexible requirements. An agreement is necessary, but you might only need a business plan for your friends or family to approve the loan. The agreement should clearly explain what the friends and family members will get in exchange for the money they are lending.

Much more documentation is required to get a startup SBA loan. For starters, you will need to have a thorough business plan outlining exactly how the funds will be used. In addition, you will need to have financial projections in the plan as well as a profit and loss statement. You will also need a personal and business financial statements. The lender will want to see that your personal finances are in good shape before approving the loan. You also will need to make an owner’s contribution, typically around 20 percent. That means if you are getting a loan for $1 million from the SBA, you will need to come up with around $200,000 yourself.

To raise money for your startup through crowdfunding, you will need a business plan that explains everything you are doing. In addition, you will need to provide financial projections for the company demonstrating how you plan to grow the company. The most important documentation, however, is going to be the marketing materials. You are going to need a strong story in the form of a pitch or in a presentation video, for example, to get people to want to invest in your campaign.

If you want to invest your own money in your startup, you can consider a 401k business loan. First, you are going to need a business plan just like you need for most other startup business loan avenues. In addition to a business plan, you are going to need financial projections, a profit and loss statement, and a balance sheet. Finally, you will need personal and business financial statements if the company has already been started. In addition to these documents, ProFinance strongly suggests that you consult an accountant, tax advisor, retirement advisor or a lawyer before taking money from your retirement account to start a business because retirement accounts are protected by strict legal procedures and terms.

Equipment financing is another great way to get the money you need to start the business of your dreams. To get this type of loan, you first need to supply bank statements. The lender is going to want to verify your cash flow. Next you are going to need financial projections and a balance sheet. The most important document that you will have to supply, however, is an approved purchase order. If you default on the loan, the lender can take ownership of the equipment.

Angel investors are another way to attract startup business funding. Angel investors will first want to see your business plan. This business plan should include a financial model. You are also going to need to provide financial projections to show the investors how much money they could make by investing in your startup. You are also going to need to show a balance sheet and profit and loss statement if the business has already been operating. Finally, you are going to need personal and business financial statements. They want to see that you are financially sound and capable of delivering a return on their investment.

*Earnings and income representations made by Joseph Buchino, and ProFinance and their advertisers/sponsors are aspirational statements only of your earnings potential. These results are not typical and results will vary. People that don't work hard to give up easily, get ZERO results. The results on this page are OUR results and from years of testing. We can in NO way guarantee you will get similar results.